UNDERSTANDING DENTAL INSURANCE

Dental Insurance benefits are not very easy to understand. Most insurance companies like Delta offer a huge variety of plans with very different benefits. The employer sponsors the plan and purchases the benefit level that they want to provide and that is affordable for them. Employers who offer dental also tend to offer more than one plan at different premiums. Many companies are no longer offering any dental benefits. It gets so confusing that people may purchase simply by price. I have patients that buy the more expensive plan thinking it will cover more and patients who buy the least expensive ones because they think all plans are the same. The information that the employer provides when you are selecting is generally confusing and can even be misleading. We encourage our patients to bring in any information they get regarding selecting their plan so that we can assist them in choosing the best plan for them.

I also encourage researching dual coverage as it does not generally benefit the patient to carry two plans. There are times when dual coverage is great especially when you are having extensive dental treatment. If you only need to have routine maintenance you will be spending more and getting the same benefit as one plan. Consider your dental needs when purchasing an additional plan. Benefits for dependents also vary widely. Many dental plans have a “non-duplication of benefits” provision meaning the second insurance will not pay any benefits if the primary plan has paid the same amount that they would have paid. You will only get a benefit if you use the primary plans maximum. Patient portions will still be 20-50 % of the cost of the service. This is a great example of cost containment that is widely used to keep profits high and reimbursement to dentist for the patient low. Interestingly when dental benefits were introduced in 1974 the annual maximums were $1000. Today most plans offer the same yearly benefit as they offered almost 40 years ago. Obviously things have gotten more expensive but the dental benefits have remained the same. To raise the maximum benefit the employer would need to pay more for the plan. I am surprised at how many different levels of reimbursement even Delta Dental has for each different employer. Coverage for a simple filling or prophy cleaning varies by over $100 dollars with some plans only covering a few dollars on a cleaning or filling.

Dental insurance can help people to pay for their routine dental visits but it has many limitations. I think of many plans as a rebate. It is better to get some benefit than to get nothing but very limited to what is covered. I am surprised by some plans as the premiums are very near what maximum benefit would be and many people never reach the max if the are on preventive maintenance. Sadly many people wait several years to get dental coverage and they neglect their teeth. They are not familiar with the benefit maximum and they think they will get their teeth taken care of now and everything will be covered. Some even think coverage is 100%. With some premiums equal to benefit max it would be better to save the money and use it for dental services, that way you can carry it over from year to year if you did not use it. We even offer an in house membership plan that can provide discounts for services if you do not have any dental insurance.

Most dental plans have many limitations. Understand where you are headed with and without dental benefits. Feel free to call or email me with questions or concerns regarding benefits or lack there of.

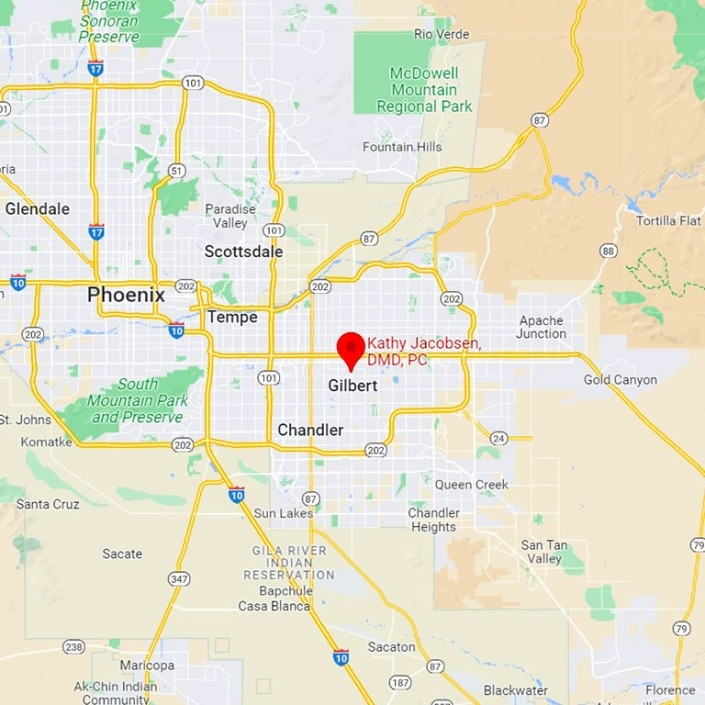

Kathy Jacobsen DMD

drkathyj@azdentistry.com

Leave a Reply

Want to join the discussion?Feel free to contribute!